1. Good Monday Morning

It’s May 10. This is George about to hit the send button shortly after President Biden declared a state of emergency regarding the ransomware attack on Colonial Pipeline, which runs from Texas to New Jersey. According to the BBC, Dark Side, an organized crime group, has infiltrated the pipeline’s computer network and caused its shutdown. About half of the fuel used in the eastern U.S. is transported through that pipeline.

Ramadan, the Muslim holy month of fasting and prayer, ends this week.

Today’s Spotlight is 1,380 words — about a 5 minute read.

2. News To Know Now

Quoted: “The majority (60%) of school apps were sending student data to a variety of third parties … On average, each app sent data to 10.6 third-party data channels.” — a new report by business group Me2B Alliance about K-12 data privacy.

a) As of Q2 2022, all Android app developers operating on the Google Play Store will be required to publish what data is collected and stored by their apps, as well as how that data is used. The new policy was announced at a time when tech companies are under increased scrutiny for mishandling customer information. (Google announcement)

b) WhatsApp will not delete your account if you don’t opt-in to its latest privacy rules that require sharing data with Facebook companies; however, customers who refuse will face account limitations such as decreased video call services and reduced notifications. The company is stressing a May 15 deadline to opt-in to data sharing. (Bleeding Computer)

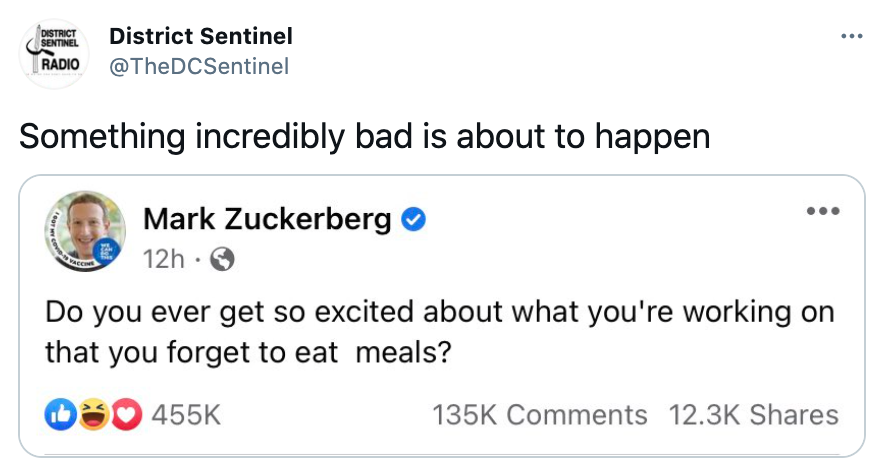

c) In an attempt to show the power of Facebook’s targeting, privacy messaging app Signal published detailed ads describing a user’s medical conditions and sexual orientation. They claimed that their campaign was halted by Facebook, but later admitted that they never submitted the ads. Worse, those ads couldn’t even be created using Facebook. (Inc.)

Our take: The loudest voice influences public perception regardless of the truth — a problem we’re afraid will happen again as these creative ads resurface in the future as proof of something that never happened.

3. COVID-19 Tech News

Data — Daily Average (7 day trailing)

US Deaths — 706

US Hospitalizations — 37,644

US Vaccinated — 34.4%

Source

Great Trackers

Overview — Johns Hopkins

Vaccine Distribution — Washington Post

Vaccine Finder — CDC Project

Risk Calculator — Brown

New York Times tracker that allows you to customize a daily email with multiple cities and towns that you’re monitoring: Click here to configure.

Coronavirus & Tech News

COVID trend: Doomscrolling Moved to Desktop – Axios

Google Backtracks, Allows Employees to Work Remotely – CNN

How to Apply for $50 Monthly Emergency Broadband Benefit Program – USA Today

4. Search Engine News

A new Google search test includes emoji embedded deep in the results page. For example, a recipe shows tiny emoji next to each option, and these eye-catching visual cues do a nice job distinguishing each separate link.

Search Engine Roundtable points out that even though Google has had both love and hate for this type of communication, this is something organization leaders should understand as more visuals replace text. It’s not just emoji. Remember that only about half of U.S. states require that cursive is taught so it’s not unique to see communication styles change within a person’s lifetime.

Microsoft Bing also announced last week that its Content Submission program is now available to the public although in beta mode. Content Submission allows websites to “notify Bing directly about URL and content changes” without having to wait for the search engine to visit and note the changes on its own.

Don’t entirely write off Microsoft Bing and its importance. The company still serves more than one billion search visitors every month.

5. In The Spotlight — Fake Reviews

New York Attorney General Letitia James issued a report last week claiming that more than eight million fake comments regarding net neutrality were sent to the Federal Communication Commission and funded by the nation’s largest internet providers. Her report says that a trade group called Broadband for America coordinated the campaign. That company’s biggest members are Comcast, Charter, and AT&T although the report said that there was no evidence of coordination by any of those companies.

According to James, the Trump administration failed to cooperate with her investigation, and former FCC Chairman Ajit Pai refused requests for evidence. The report published by her office last week said that nearly 18 million of 22 million comments had been falsified.

Net neutrality is a principle that requires internet providers to treat all traffic the same way regardless of its source. That means an internet provider that also owns entertainment channels cannot slow down or impede traffic from Netflix or another competitor. Pai oversaw the repeal of net neutrality in the United States more than three years ago.

Amazon is another organization often accused of having fake reviews and comments about its products, especially in its third party marketplace. Researchers discovered a treasure trove of data last week that contains millions of records implicating third party sellers on Amazon who paid for fake reviews.

Safety Detective found a server online with no encryption or passwords. The data included email addresses, WhatsApp and Telegram phone numbers, payment data, and links to 75,000 Amazon accounts of seemingly fake review sellers.

The company estimates that between 200,000 and 250,000 people worldwide were involved in the fake review scam.

6. Debunked — Those Carter Biden Photos

By now you’ve read that the images of the Bidens and Carters published last week that looked disproportionate were possibly the result of using a wide-angle lens in a smaller space.

For your debunking purposes, though, be aware that a zoom lens can have an opposite effect. Photographer friends were quick to show me some misidentified photos during the pandemic that appeared to show crowds where none existed.

There are several great examples in The Guardian that you’ll want to look at.

7. Following Up — Apple’s Tracking Opt-Out

We’ve been writing about the new iOS 14.5 update and its requirement that users explicitly opt-in to being tracked by apps. Facebook has waged a monthslong campaign against Apple and this feature. Industry observers were concerned that as much as 80% or more of the Apple user base would opt out.

We frankly didn’t know why anyone would opt-in and were therefore not surprised to learn that 96% of US users have opted out so far. We think that number is high and will decrease over time, and we love data.

8. Protip — New iOS 14.5 Features

This was a big upgrade. Lifehacker has a feature they’ve helpfully called “How to Set Up Every iOS 14.5 Feature Worth Knowing About,” including the new Siri voices and how to take screenshots without a pop-up.

9. Screening Room – Saucony & Moms

10. Science Fiction World — West Cost Earthquake Warnings

ShakeAlert is an early earthquake warning system that as of last week covers 50 million people living in California, Oregon, and Washington. All mobile devices will receive a warning with up to 10 seconds advance notice of an earthquake of at least magnitude 5.

11. Coffee Break — Top Music by Town

The Pudding may be the best data visualization website online. One of their latest projects geocodes music listened to on YouTube and then maps the top song in each area. The data can even differ in adjacent communities. There is a different top song in the community where my son and his wife live only 15 miles away.

It’s remarkable work that you’ll want to spend time with.

12. Sign of the Times